nj property tax relief for seniors

Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Property Taxes Site Fees.

Benefits Of Owning A Home Advantages Of Owning A Home Re Max Nj Home Ownership Home Buying Buying A New Home

Check Your Eligibility Today.

. Average bill more than 9000. Prior Year Property Tax Reimbursement Senior Freeze. The units are equal in size and one of the units was your principal residence.

Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. To put this in perspective the average NJ citizen paid approximately 8861 in taxes in 2019. You also may qualify if you are a surviving spouse or civil union partner.

FAIR LAWN Building on his commitment to making New Jersey stronger fairer and more affordable Governor Phil Murphy today unveiled the ANCHOR Property Tax Relief Program a new initiative that will distribute 900 million in property tax relief to nearly 18 million homeowners and renters across the state during Fiscal Year 2023 FY2023. You will get the difference between your base year first year of eligibility property tax amount and the current year property tax amount as long as the current year is higher than the base year and you met all other eligibility. In addition to the Senior Tax Freeze program you can find out more about property tax exemptions in NJ.

Under the current state budget about 340 million was earmarked to fund Homestead property-tax relief benefits that go to thousands of seniors and disabled homeowners making up to 150000 annually and other homeowners making up to 75000 annually. But first its important to note that New Jersey has frozen 920 million in state government spending including 142 million in Homestead. To receive the reimbursement an applicant must satisfy all eligibility requirements established by the State of New Jersey and file annually.

Ad All Adults over 50 are Encouraged to Apply For These Benefits Discounts. Nearly 18 million homeowners and renters would get property tax rebates averaging 700 next year under a new plan Gov. NJ property taxes climbed again in 2020.

CuraDebt is an organization that deals with debt relief in Hollywood Florida. Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Mortgage Relief Program is Giving 3708 Back to Homeowners.

Senior citizens disabled persons or surviving spouses People who are 65 or older disabled or widowers of such person have the right to claim a 250 tax deduction. Visit Requirements for Resuming Eligibility for more information. In all Murphys plan would expand the number of homeowners who.

And for the senior-freeze program Treasury officials have estimated the FY2022 budget will fund reimbursements averaging 1404 for 152935 senior and disabled homeowners already eligible for the program. This property tax relief program does not actually freeze your taxes but will reimburse you for any property tax increases you have once youre in the program. Under Murphys plan the smallest benefits would go to homeowners making between 150000 and 250000.

Phil Murphy unveiled Thursday. About the Company Nj Property Tax Relief Senior Citizens. Senior and disabled homeowners in that category would receive average benefits totaling 571 and for all other homeowners in that category the average benefits will total 537.

Save on Mortgage Payments Electricity Bills and even Travel. If you qualify to use Form PTR-2 and you did not receive a personalized application call the Property Tax Reimbursement Hotline at 1-800-882-6597 to request that we mail one to you. County and municipal expenses.

Renters making up to 100000 would be eligible for direct payments. If you are age 65 or older or disabled and have been a New Jersey resident for at least one year you may be eligible for an annual 250 property tax deduction. Since you occupied only one-fourth 25 of the property your benefit is based on 25 of the property taxes.

The main reasons behind the steep rates are high property values and education costs. Ad 2022 Latest Homeowners Relief Program. Amounts that you receive under the Senior Freeze program are in addition to the States other property tax relief programs.

If you live in New Jersey you can count on the following ones. The Senior Freeze Property Tax Reimbursement program reimburses senior citizens and disabled persons for property tax increases. 3 rows The state of New Jersey provides senior citizens and people with disabilities with some relief.

If its approved by fellow Democrats who. For New Jersey homeowners making up to 250000 rebates would be applied as a percentage of property taxes paid up to 10000. The Property Tax Reimbursement Program is designed to reimburse senior citizens age 65 and older and disabled persons for property tax increases.

Besides education property taxes in NJ also fund. Check If You Qualify For 3708 StimuIus Check. Tax Reimbursement for Senior Citizens.

If you moved from one New Jersey property to another and received a reimbursement for your previous residence for the last full year you lived there you may qualify for an exception to re-applying to the Senior Freeze Program. Ad 2022 Federal Homeowner Relief Program is Giving a One Time 3627 StimuIus Check. For applicants who met all the eligibility requirements for 2020 and again for 2021 the amount of the 2021 re-imbursement will be the difference between the amount of property taxes that were due and paid.

It was established in 2000 and is an active member of the American Fair Credit Council the US Chamber of Commerce and is accredited by the International Association of Professional Debt Arbitrators.

We Re Willing To Make A Deal To Restore N J Property Tax Break Top Biden Official Says Nj Com

Giving To Charity This Holiday Season Why The New Tax Plan Changes Everything Tax Deductions Deduction Tax Services

Can Your N J Property Taxes Actually Be Reduced We May Soon Find Out Nj Com

We Re Willing To Make A Deal To Restore N J Property Tax Break Top Biden Official Says Nj Com

Cancellation Of Homestead Deduction The District Of Columbia Here S A Free Template Create Ready To Use Forms A Deduction District Of Columbia How To Apply

Nj Property Tax Relief Program Updates Access Wealth

Map Of The Top 5 Highest And Lowest Median Property Tax Payments In America Find This Image On Blog Phmc Com Property Tax Tax Payment Mortgage Payment

Property Tax Reduction Should You Hire An Expert Tax Reduction Property Tax Tax Consulting

Berkeley Residents Urged To Apply For Nj Property Tax Rebates Best Home Loans Credit Card Debt Settlement Project Management Professional

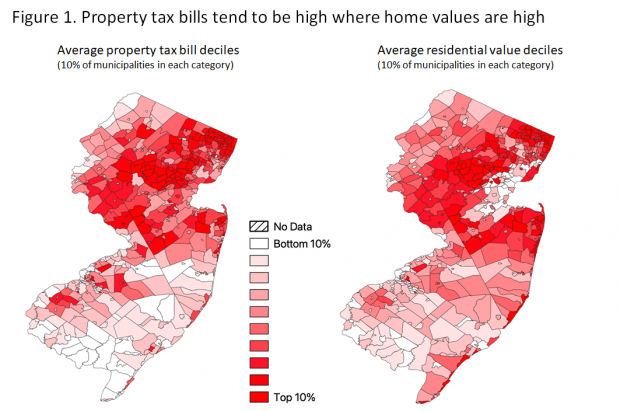

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Good Comparison Of The House Vs Senate Tax Bills Tax Deductions Senate Real Estate

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Documentation For Loan Against Property What You Need To Know Tax Debt Relief Property Tax Tax Debt

Printform Finance Incoming Call Screenshot Property Tax

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax